SELIC VS IPCA: the duel of the year analyzed from the perspective of econometrics

By Daniel Christian Henrique and Ivan Aune de Aguiar Filho (Probolsas extension scholarship holder)

The topic that has been most discussed in the last six months in the economic area is the preparation of the Fiscal Framework by the federal government, with its subsequent approval or not by congress and the senate (to be voted on in this last instance next week). There is no way not to address this issue in the economic area of any public or private sector, as it directly affects your finances. As? This is the debate: economists focus on simulations to understand whether the approval of a more rigorous public budget rule will make it possible to reduce the basic interest rate of the national economy by the Central Bank, our old known Selic Rate. Currently, the so-called which accounts for the highest percentage in the world, at the already known 13.75% per year - which has been maintained in recent Copom meetings.

With possible future reductions in the Selic, more financing would be encouraged by both individuals and legal entities, generating more investments, more jobs, more income, more purchases, in short... the wheel of the economy turns. But to what extent without losing inflationary control? It is important to remember that in conditions of high inflation, those who lose the most resources and jobs are the poorest. Therefore, the problem is not the easiest...

The GPFA , in order to maintain its constant impartiality in the analyses, will briefly discuss the position of the two sides in the "conflict": Central Bank x Federal Government, and then analyze the data econometrically.

1 - The BC's vision . The global inflation that has hit the world recently did not catch the Central Bank of Brazil by surprise, already "hardened" by very high inflation and its consequences decades ago. It anticipated the monetary tightening on the Selic, making Brazilian inflation one of the lowest in the world , lower even in comparison to several developed countries that delayed their tightening too much due to the lack of skill they still have with the novelty that is inflation in their discussion agendas.

2 - The Federal Government’s perspective. On the other hand, the Ministry of Economy does not think it is necessary to have very low inflation, so "first world", at the expense of low investments (caused by the high costs of bank financing at a rate of 13.75% as a parameter) and consequently low generation of jobs, which could be greater with just one or two percentage points more annual inflation. Furthermore, they indicate that the persistence of such a high interest rate leads to a systemic breakdown of the business community over the years.

Here's the problem. What to do?

Absolutely sure which is the best path to follow, probably no one is. But analyzing data from the past and trying to project the future is a service to the population that econometrics proposes. It is worth remembering, however, that the BC is still independent of the federal government, and it is common knowledge that there is no key that directly links changes in the Selic to changes in inflation rates and consequently also to a possible increase in national GDP. However, this possible relationship is expected (even confirmed by both sides recently in frank conversations that are ongoing) if an adequate fiscal framework is designed.

Another point of common agreement among economists is that there is a TIME DELAY in this relationship between a reduction in the Selic rate and an increase in inflation, followed by increases in GDP. The BC management argues that it could take more than a year for the Selic to reduce with an adequate fiscal framework approved, but pro-government parliamentarians insist that it is too long and until then, the "cow has gone to waste" in thousands of businesses ... because until this reaches economic growth, the time would be even longer.

What is known is that reductions in the current Selic rate would not result in instant increases in investments or an immediate impact on inflation. A few months are expected for the economy to respond. But how many months? Would this time be acceptable for both parties?

This study, therefore, intends to analyze the temporal impact that a reduction in the Selic Rate can cause in possible inflationary increases and increases in national GDP

Other adjacent relationships were tested to complement the proposed analyses. To achieve the objectives, an Autoregressive Vector (VAR) was developed between the following time series, collected between the period of May 2000 and May 2023:

- Selic Rate - Target (Central Bank)

- IPCA (Broad Consumer Price Index - IBGE)

- GDP (Gross Domestic Product - IBGE)

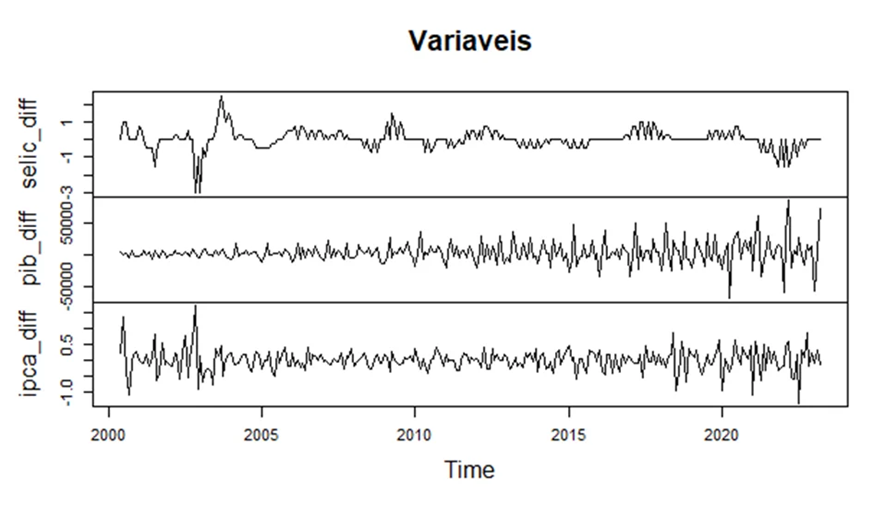

The three time series underwent differentiation to obtain stationarity with p-value 0.01 in the ADF ( Augmented Dickey-Fuller ) test, as shown in the following graph:

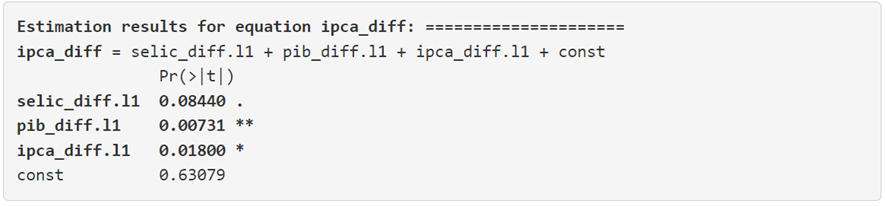

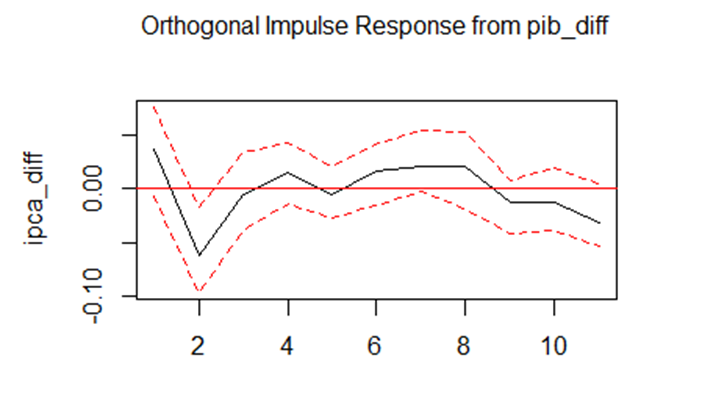

Due to the fact that the central objective of this study is based on possible reductions in the Selic, the first step of the analyzes was to carry out treatments on the data to apply negative shocks of 1 standard deviation to the residue of the Selic Rate predictive equation - in order to verify increases or not in the results of the IPCA predictive equation using the FIR (Impulse-Response Function) tool. To investigate the impact of GDP under the IPCA, positive shocks of 1 standard deviation were applied to the residue of the GDP equation, trying to visualize what impacts a growth in the national economy would generate on the results in the IPCA equation.

The temporal delay tests (lags) allowed two aspects of analysis: short term , considering only the last COPOM meeting and medium term , considering in this case all COPOM meetings in the last two years (held every 45 days to define the update Selic Rate or not).

With maximum values of 1 lag, that is, 1 month of delay, approvals were obtained in the delay and causality tests. When considering maximum delays configured for up to 24 months, it also obtained excellent approval for 12 months of delay and the causalities - explained below.

IPCA inflation and the last Copom meeting

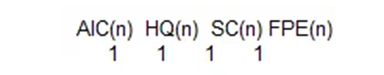

The adequacy of the IPCA predictive equation considering only the last Copom meeting (inserting only data from the series related to the previous month as delay) was approved in the lag tests (AIC, HQ, SC and FPE):

The equation, the results of its coefficients, as well as the causality tests and Impulse-Response Functions (FIR) obtained were:

p-value Granger Causality IPCA (Y) ~ Selic (X) = 0.0985

p-value Granger Causality IPCA (Y) ~ GDP (X) = 0.0833

p-value Granger Causality GDP (Y) ~ IPCA(X) = 0.2576

Conclusions:

- The current month's inflation measured by the IPCA is impacted by the Selic variations defined at the last Copom meeting;

- The current month's inflation measured by IPCA is impacted by the previous month's GDP variation. However, the opposite does not happen: the current GDP does not change with changes in the IPCA rate that occurred just one month ago.

- The variation in the IPCA of the previous month impacts the IPCA of the current month;

- A reduction in the Selic Rate ( negative shock ) by the Central Bank causes increases in the IPCA for up to six future months, stabilizing thereafter. The opposite, therefore, is true: a positive shock simulating an increase in the Selic Rate, generates inflationary reductions measured by the IPCA in the same period of time.

- An increase in national GDP in the current month ( positive shock ) is related to a fall in the inflation rate (IPCA) for up to three months, then stabilizing.

IPCA inflation and Copom meetings in the last 12 months

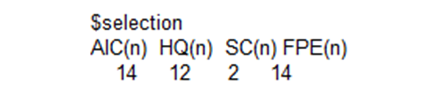

The maximum longitude tests, considering the last two years of Copom meetings, indicated the relevance of use only with 14, 12 or 2 months of monthly delays in the causal relationships.

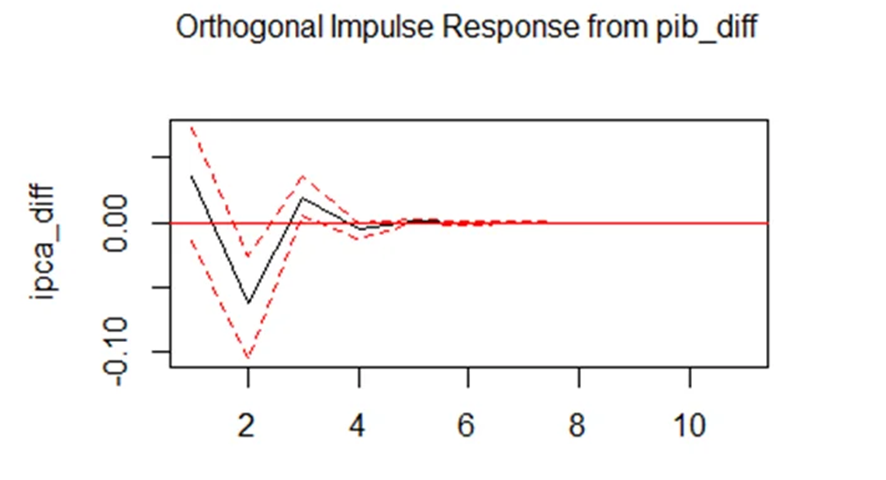

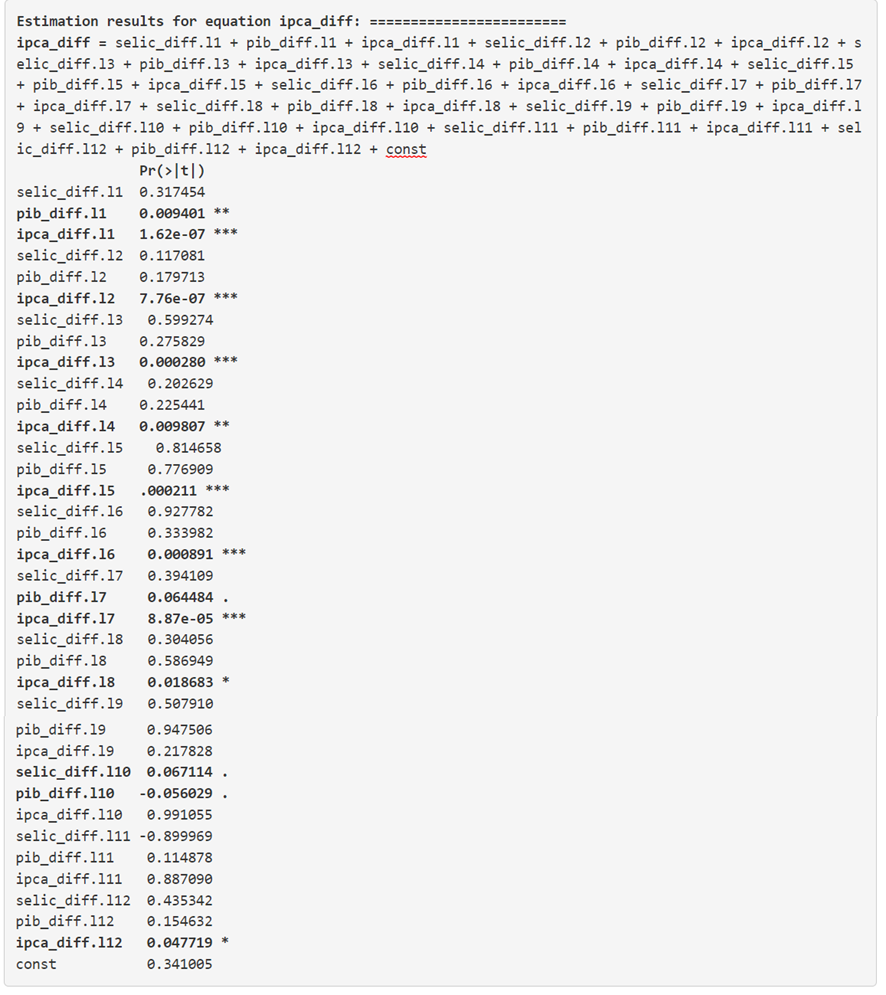

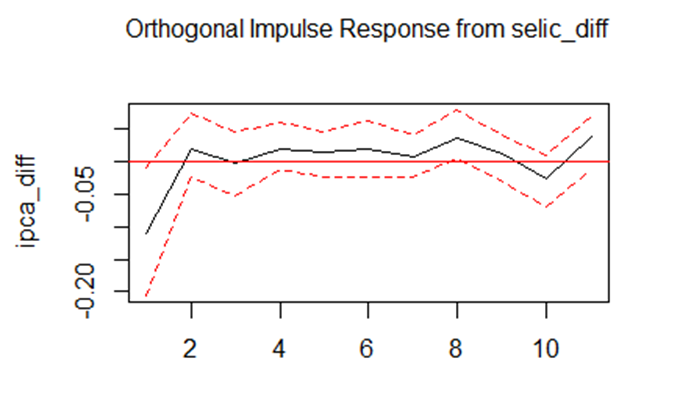

After several tests with all indicated lags, the results that resulted in significant impacts were 12 months late. In a year, 8 Copom meetings take place to define changes or changes to the Selic Rate. Finally, the IPCA predictive equation, the results of approval or not of its coefficients, as well as the causality tests and Impulse-Response Functions obtained were:

p-value Granger Causality IPCA (Y) ~ Selic (X) = 0.09842

p-value Granger Causality IPCA (Y) ~ GDP (X) = 0.1493

Note: although the Granger causality between GDP (X) and IPCA (Y) was rejected, there was a good approximation to approval due to its p-value, as well as 3 lags of the GDP coefficients approved (1, 7 and 10 lags) in the VAR equation. Therefore, it was decided to maintain this analysis.

p-value Granger Causality GDP (Y) ~ IPCA(X) = 0.652

The opposite direction, however, could not be inspected, as seen above in the strong disapproval of the p-value of the causality that the IPCA causes in GDP.

Conclusions:

- The current month's inflation measured by the IPCA is impacted by the Selic variations defined in the Copom meetings over the last 12 months (one year);

- The current month's inflation measured by IPCA is impacted by GDP variations over the last 12 months. However, the opposite does not happen: the current GDP does not change with changes in the IPCA rate that have occurred in the last 12 months. Note: although this direct relationship is not contacted, changes in inflation impact several productive segments, which in turn can impact the national economy. This relationship may take several indirect steps to reach GDP, but these are not addressed in this study.

- Variations in the IPCA over the last 12 months impact the IPCA in the current month;

- A reduction in the Selic Rate ( negative shock ) by the Central Bank causes increases in the IPCA for up to nine future months, stabilizing thereafter. The opposite, therefore, is true: a positive shock simulating an increase in the Selic Rate, generates reductions in the IPCA in the same period of time.

- An increase in national GDP in the last month ( positive shock ) is related to a fall in the inflation rate (IPCA) for up to three months, then stabilizing.

References: Central Bank (a) , Central Bank (b) , IBGE (a) , IBGE (b)

How to cite this newsletter? (ABNT standard)

HENRIQUE, Daniel Christian; AGUIAR-FILHO, Ivan Aune. SELIC vs IPCA: the duel of the year analyzed from the perspective of econometrics . 2023. Developed by GPFA - Analytical Finance Research Group. Available at: https://www.gpfa.com.br/informes/selic-x-ipca . Accessed on: (date of access to the website).