IBOV vs SELIC: Beginning of a new investment reversal cycle?

By Daniel Christian Henrique and Ivan Aune de Aguiar Filho (Probolsas extension scholarship holder)

After back and forth conversations and clashes between the Government and the Central Bank, followed by a certain conciliation between the parties following a promised fiscal framework framed by fiscal targets, COPOM reduced the basic interest rate again this September at its last meeting. of the economy, the Selic , by another 0.5 pp. offering fulfillment of what was promised in the first cut of the meeting prior to maintaining the downward cycle of the national economy's basic rate. It has now reached 12.75%. Although still very high compared to the rest of the world, it is already some relief for those seeking medium or long-term business (or even personal) financing, compared to the previous 13.75% that little was moving anchored in the negotiations of the combat inflation.

Looking in the rearview mirror, at the height of the pandemic, in the opposite direction, the Selic parked at very low rates of 2% to 3%, generating a migration of a portion of investments from fixed income to the capital market. During this period, B3 strongly increased its number of registered CPFs, breaking some consecutive records for new investors. Taking a little more risk began to compensate for some in the face of the very low return that traditional savings applications, CDBs, LCIs and Tesouro Direto (linked to the CDI/Selic) were obtaining - which were basically just updating inflation, not generating real gains. It was a new frontier to be discovered for many Brazilians - notoriously conservative.

The tide did not last long, as new adjustments to the Selic rate soon came, accounting for a new upward cycle, to combat inflation that rose month by month as the country left the context of lockdowns , reactivated work activities and of consumption... and it hasn't stopped... It went from 3.5% in June 2021 to 13.75% in September 2022 - in just over a year. Soon, the process was reversed, and fixed income investments once again attracted new large amounts of national and international investments. The conservatism of beginners at B3 speaks louder again! And this entry and exit from the capital market and fixed income seems to constantly continue as the Selic's cycles of rise and fall take shape, mainly to combat inflation (a common monetary policy measure at the BC for decades). Therefore, it is to be expected that the beginning of the cuts in the current high basic interest rates will now begin, again, the opposite path: a portion will return to variable income. It will be?

This is the purpose of this study: to statistically investigate the dependence of the Ibov score on changes in the Selic rate by COPOM, as well as what the delay period (lag) of this impact would be.

Vector Autoregressive (VAR) methodology was adopted to analyze the lagged relationship of the following time series collected and adjusted for monthly data between May 2000 and August 2023:

| Variable | Source |

| Interest rate - Selic target defined by Copom - % am | Central Bank |

| Ibov - monthly score | Economatica |

Results:

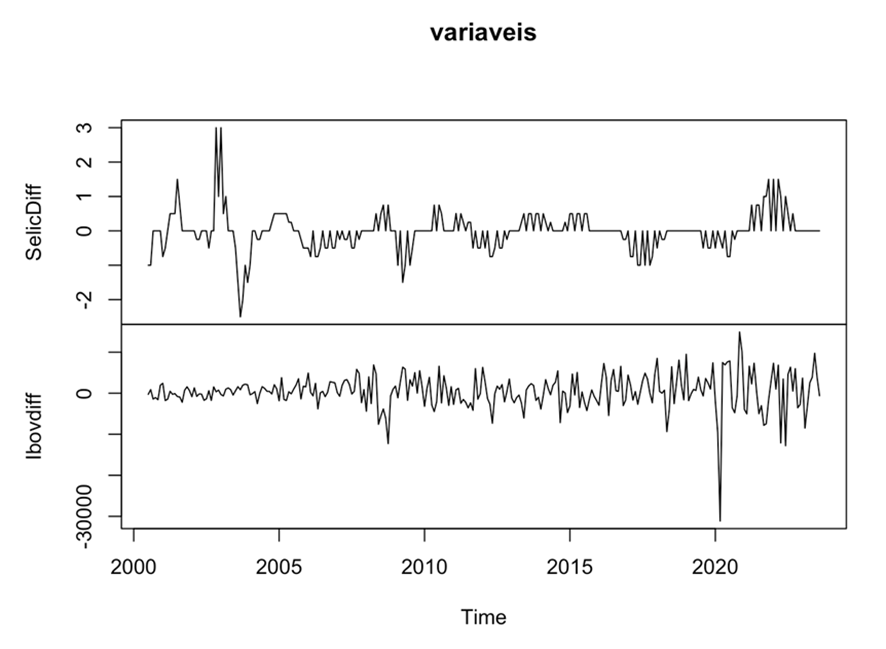

Both variables needed to undergo differentiation in order to obtain stationarity using the Dickey Fuller- Augmented (ADF) test at a significant p- value of 0.01, generating the following graph of the series in difference:

As a second step, the ideal maximum temporal size test was carried out for the lag between the variables, obtaining the following results.

| AIC(n) | HQ( n | SC(n) | FPE(n) |

| 4 | two | two | 4 |

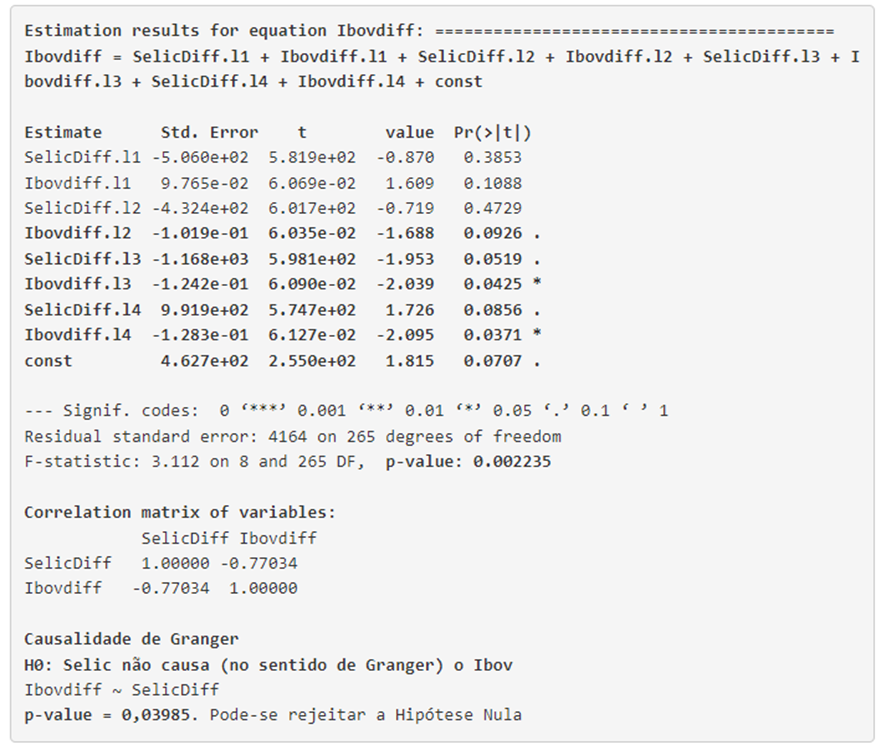

Given the tie between lags 2 and 4, both were tested for the approval of the coefficients in their vectors, as well as in Granger Causality. The relationship that showed approval of changes in the Selic rate to future impacts on the Ibov was just the VAR with a 4-month delay. The analyzed predictive equation is presented below:

Finally, the following results can be established:

- A change in the Selic rate made by COPOM will impact the Ibov score between three and four months ahead.

- The negative relationship obtained in the correlation matrix of the variables allows us to state that an increase (decrease) in the Selic decreases (increases) the Ibov score also in a contemporary way (in the same month).

- The result of the Granger Causality test (p- value = 0.03985) refutes the null hypothesis, that is, changes in the Selic contribute to changes in the Ibov score - confirming the results obtained in the p- values of the VAR coefficients;- All four months of Ibov lag generates a self-impact on itself.

References: Central Bank , Economatica

How to cite this newsletter? (ABNT standard)

HENRIQUE, Daniel Christian; AGUIAR-FILHO, Ivan Aune. SELIC vs IBOV:Beginning of a new cycle of investment reversal? 2023. Developed by GPFA - Analytical Finance Research Group. Available at : https://www.gpfa.com.br/informes/ibov_vs_selic . Accessed on: (date of access to the website).